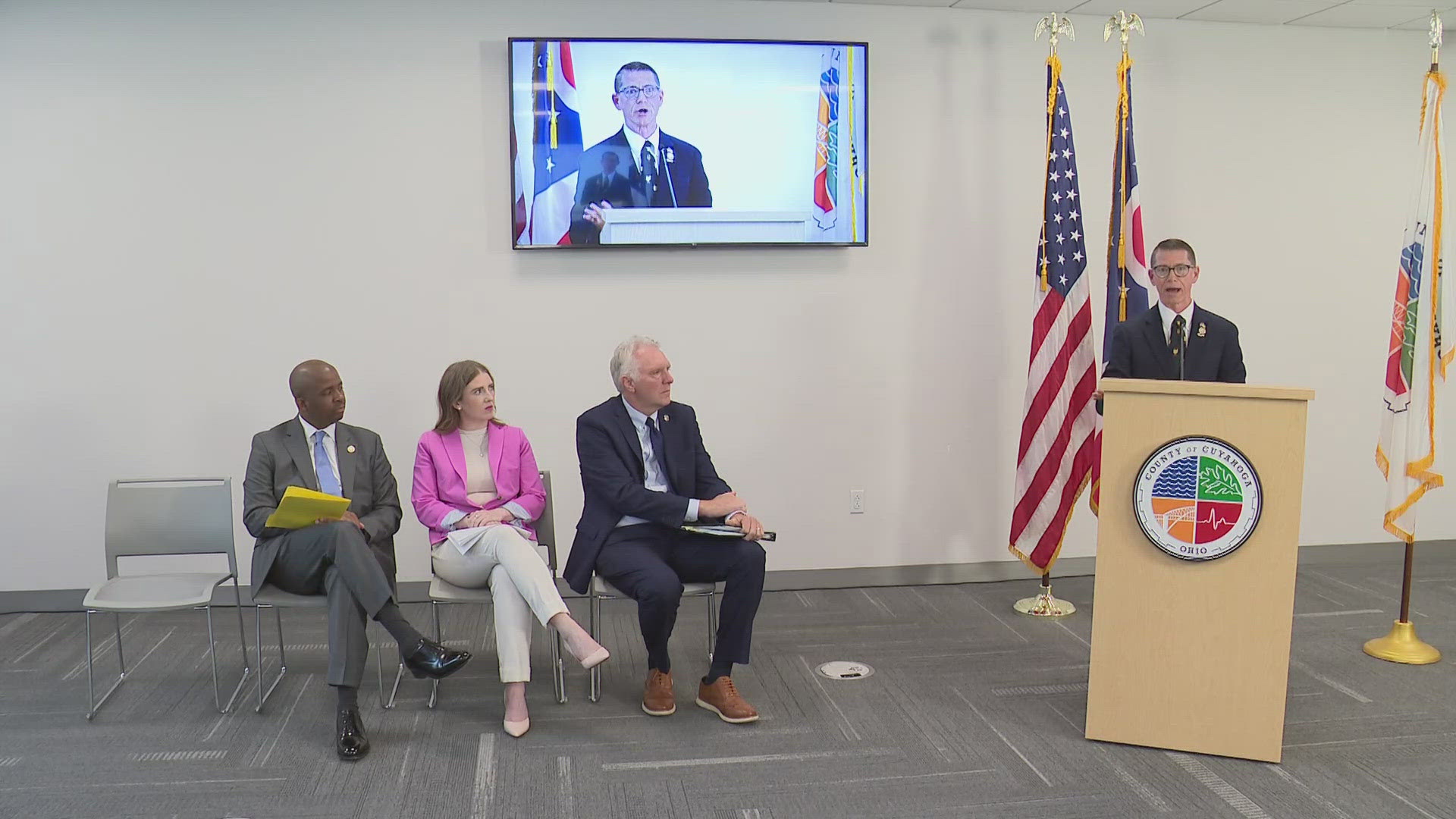

CLEVELAND — Tuesday morning, Cuyahoga County Executive Chris Ronayne and Democratic state representatives held a press conference calling for swift legislative action to address rising property taxes.

By state law, counties in Ohio are required to reappraise properties every six years to determine property taxes. This summer, Cuyahoga County rolled out new appraisals, shocking some property owners who saw sudden spikes to their taxes.

Property values in Cuyahoga County rose by an average of 32%, with some areas seeing increases of nearly 70%.

"When someone loses their home, the whole community loses, because there's this spiraling effect of community loss when there's somebody out on the streets, somebody that can't pay their bills," Ronayne said. "We need the state's full-throttle support to make things happen."

Ronayne opened Tuesday's presser by emphasizing the need for legislative. He then passed the microphone to the three state representatives in attendance: Bride Rose Sweeney (D-Westlake), Phillip M. Robinson (D-Solon), and Sean Patrick Brennan (D-Parma).

They discussed multiple pieces of proposed legislation that could expand homestead exemptions, freeze property taxes for seniors, and provide monetary relief for Ohioans.

"Because your home value increases does not mean that Ohioans all of a sudden have more money in their pockets," Sweeney noted, further arguing that the state budget has the money to pay for property tax relief, but the legislature needs to come together and use it.

Robinson is advocating for the passage of House Bill 573, which he says would raise state financial support to local governments back to 2008 levels. He claims the money would help support police, fire, and service departments, which would take some of the burden off taxpayers.

3News asked Ronayne whether the county invited any Republican lawmakers to be a part of the press conference.

"We have asked for relief from Republicans many times, and I'm sure — and I will say — the door is always open," he answered. "We need the support, we need them to show up, we need them to listen, we need them to lead, we need them to do something."

In a July interview, Republican Rep. Adam Bird, of New Richmond, discussed his own bill to lower property taxes that stopped just short of Gov. Mike DeWine's desk. He told us the bill was drastically changed in the State Senate and that he could no longer support it.

3News will be tracking whether any property tax relief gains traction in the legislature. In the meantime, the county is reminding property owners that Friday, Aug. 30, is the deadline to submit an informal complaint. The county encourages property owners to file if they do not believe they can sell their property for the value assessed by the county, and those complaints can be submitted here.

After that deadline passes, property owners will need to file complaints with the county Board of Revisions here.