WASHINGTON — World leaders reacted to Russia's invasion of Ukraine Thursday by unleashing robust sanctions on the Russian economy, President Vladimir Putin's inner circle and many of the country's oligarchs.

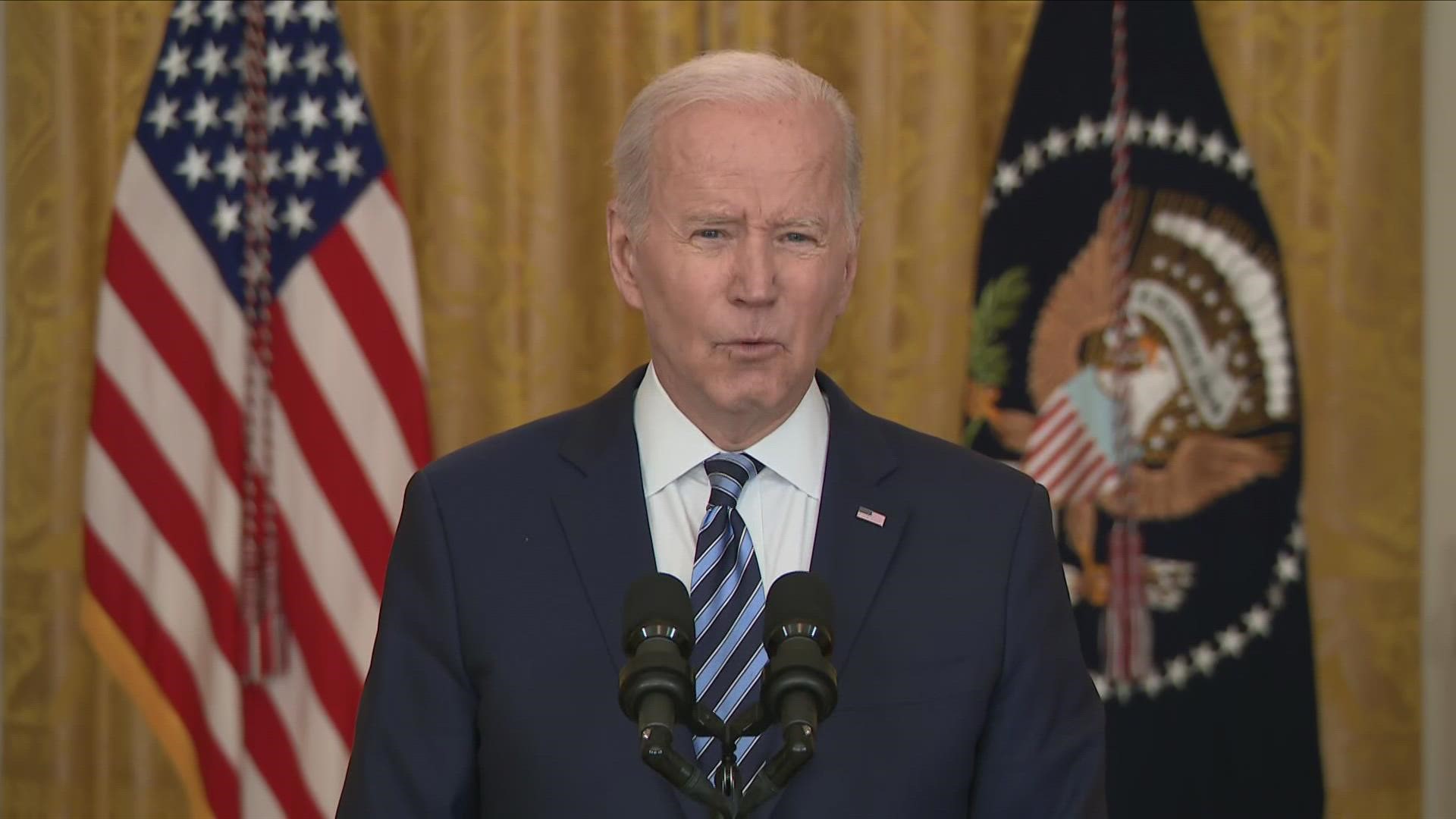

One leader announcing heavy sanctions was President Joe Biden, who said the United States will block assets of large Russian banks, impose export controls aimed at the nation's high-tech needs and sanction its business oligarchs. Ukrainian officials urged the U.S. and the West to go further and cut the Russians from the SWIFT financial system.

“We demand the disconnection of Russia from SWIFT, the introduction of a no-fly zone over Ukraine and other effective steps to stop the aggressor,” Ukraine President Volodymyr Zelenskyy said in a tweet.

But the Biden administration has shown reluctance to cut Russia from SWIFT, at least immediately, due to concerns for Europe and other Western economies. Biden, answering questions from reporters, appeared to push a decision on SWIFT to European allies.

“It is always an option but right now that’s not the position that the rest of Europe wishes to take,” Biden said.

What is SWIFT?

The Society for Worldwide Interbank Financial Telecommunication, or SWIFT, is a Belgium-based cooperative of financial institutions. It is overseen by the National Bank of Belgium in partnership with the U.S. Federal Reserve System and other central banks.

Unlike a traditional bank, the SWIFT financial system doesn't hold deposits. It handles millions of messages each day, linking more than 11,000 financial institutions around the world. SWIFT said in 2021, it recorded an average of 42.0 million messages each day.

"It doesn't move the money, but it moves the information about the money," Alexandra Vacroux, executive director of the Davis Center for Russian and Eurasian Studies at Harvard University, told NPR last month. She added that cutting Russia from the system is seen as the "nuclear option" because of its wide-ranging impacts.

What would happen to Russia and other countries?

For the U.S. and its European allies, cutting Russia out of the SWIFT financial system would be one of the toughest financial steps they could take, damaging Russia’s economy immediately and in the long term. The move could cut Russia off from most international financial transactions, including international profits from oil and gas production, which in all accounts for more than 40% of the country’s revenue.

Officials in Europe have noted that the loss of SWIFT access by Russia could be a drag on the broader global economy. Russia has also equated a SWIFT ban to a declaration of war. And because the system cements the importance of the U.S. dollar in global finance, outright bans also carry the risk of pushing countries to use alternatives through the Chinese government or blockchain-based technologies.

Has it been used in sanctions before?

Allies on both sides of the Atlantic also considered the SWIFT option in 2014, when Russia annexed Crimea and backed separatist forces in eastern Ukraine. Russia declared then that kicking it out of SWIFT would be equivalent to a declaration of war. The allies — criticized ever after for responding too weakly to Russia’s 2014 aggression — shelved the idea.

Russia since then has tried to develop its own financial transfer system, with limited success.

The U.S. has succeeded before in persuading the SWIFT system to kick out a country — Iran, over its nuclear program. But kicking Russia out of SWIFT would also hurt other economies, including those of the U.S. and key ally Germany.