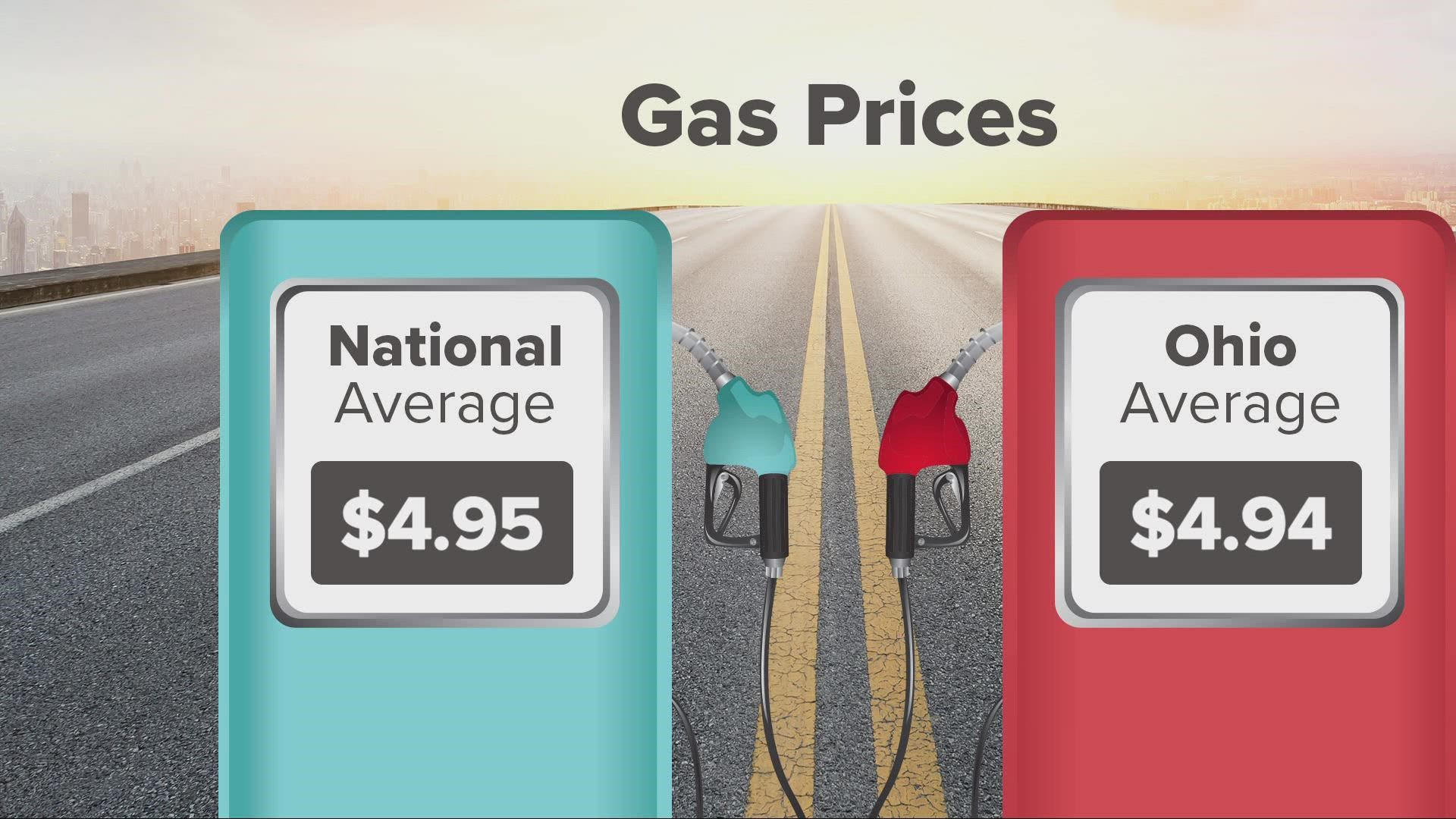

CLEVELAND — With gas prices still hovering near record highs, many people are looking for new ways to save.

But is getting a gas credit card or joining a warehouse club worth it? Consumer Reports investigated.

Depending on where you live, you're paying anywhere from $3 to $5 for a gallon of gas. There are, of course, apps like GasBuddy, AAA, and Gas Guru to help you find the lowest prices in your area, but what about applying for a credit card issued by a gas station or oil company?

Many gas cards pay you back a few cents per gallon of gas—like 5 cents or 10 cents—rather than a percentage of your purchase. So when gas prices are moving up from $3 to $4 or $5, that benefit is worth a lot less.

Instead, CR says look for a credit card with no annual fee that offers rewards, like 5% cash back on gas purchases. Although many gas stations offer a lower price if you pay with cash instead of using a card, the card's cash back reward could actually be a better deal.

One example is the Citi Custom Cash Card, which gives you 5% cash back on your top spending category each billing cycle for up to $500 in purchases. That includes gas.

Other options are warehouse clubs, such as Sam's Club or Costco, which offer their own credit cards that pay you back a percentage on your gas purchases. If you do a lot of driving and think you'll reach the card's cap, consider using that card only when buying gas.

If you don't belong to a warehouse club, now's a good time to consider it. That's because gas prices there are almost always lower than at traditional gas stations. Those gas discounts alone may be worth the membership cost, though your savings will vary depending on your location and your mileage.

Consumer Reports says to max out your discounts; try to combine them with other rewards programs whenever you can. Many gas brands have their own apps that offer a few cents off per gallon and they don't require a gas-branded credit card, so you can use your rewards credit card to pay for your gas instead.